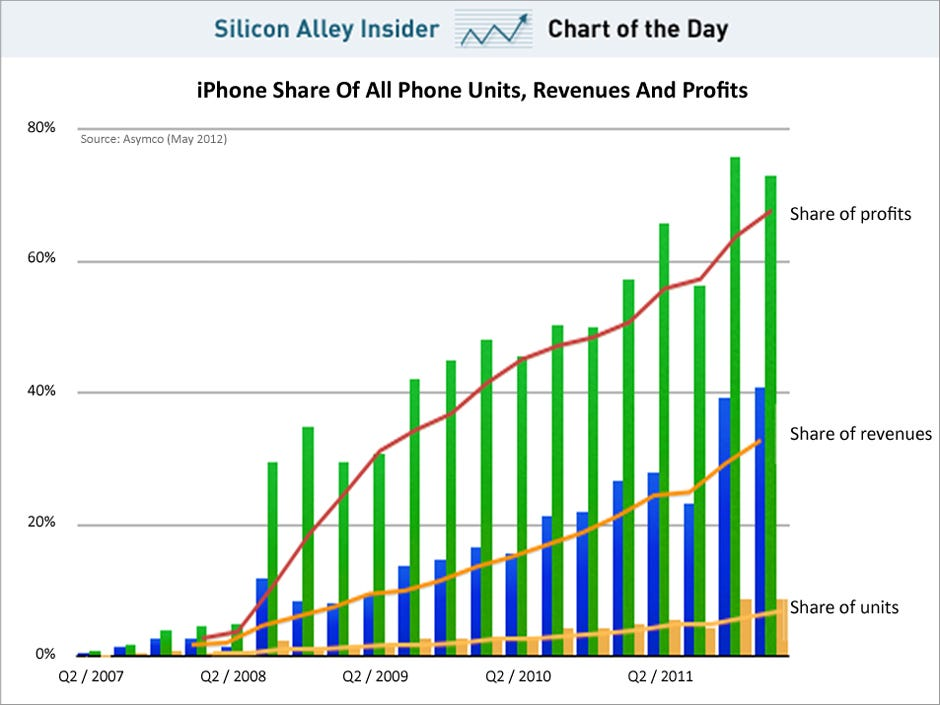

Apple smartphone profits have long dominated the tech landscape, with the company securing an astounding 94% of total profits in Q3 2015, despite a mere 13.4% share of global smartphone shipments. This extraordinary financial achievement underscores Apple’s ability to thrive within a competitive smartphone market, where brands like Xiaomi and Huawei are flooding in with low-cost alternatives. The loyal customer base of Apple has proven willing to pay a premium for iPhones, participating in long lines for the latest releases. While Apple’s market share remains modest at 13.5%, their profit margins hover at unprecedented levels, evidencing the power of brand loyalty in the Apple vs Android competition. As these figures emerge from Canaccord Genuity, they reflect both the dominance of Apple in profitability and the shifting dynamics within a landscape increasingly populated by budget-friendly smartphones.

In the realm of mobile technology, the financial triumph of Apple’s smartphone division paints a vivid picture of market dynamics and consumer behavior. With an impressive 94% profit share reported for Q3 2015, Apple has managed to navigate the challenging waters of a smartphone landscape where numerous competitors, including the likes of Xiaomi and Huawei, offer budget-friendly options. Apple’s continued success can be attributed to its established consumer loyalty and premium pricing strategy that resonates with its ‘brand-centric’ clientele. Despite holding only 13.5% of the total smartphone market, this achievement underscores the intense competition between Apple and the Android ecosystem, particularly as brands like Samsung and Xiaomi struggle to maintain their foothold. The need for innovative strategies to capture an increasingly expansive market is more critical now than ever.

Apple’s Dominance in Smartphone Profits

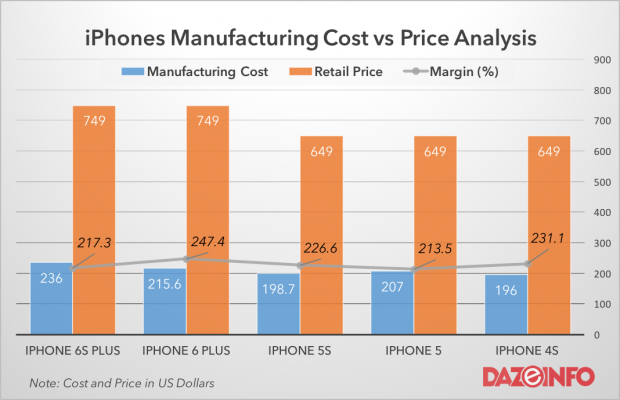

In Q3 2015, Apple achieved a remarkable feat by capturing 94% of the total profits in the smartphone industry, despite holding only a 13.4% share of the overall smartphone market. This staggering percentage illustrates Apple’s ability to command high profit margins on their flagship iPhones, which are often priced at a premium. The company has effectively cultivated a brand loyalty that has led customers to eagerly line up for hours, showing their dedication to acquiring the latest device from Apple, regardless of the cost. Their dominance in profits can primarily be attributed to their strategic marketing and innovation, which sets them apart from competitors.

This substantial profit margin starkly contrasts with rivals like Samsung, which managed to secure only 11% of total Q3 profits that same year. The smartphone market, particularly at that time, was witnessing a shift towards more affordable alternatives offered by brands like Xiaomi and Huawei, whose low-cost devices appeal to a budget-conscious demographic. However, these companies operate with thin profit margins, which drastically affects their overall profitability compared to Apple. Therefore, while they may capture a significant market share, their financial gains are not comparable to that of Apple, showcasing the tech giant’s superior positioning in the high-end smartphone sector.

The Impact of Low-Cost Smartphones on Market Dynamics

The emergence of low-cost smartphones from brands like Xiaomi and Huawei has undeniably altered the landscape of the mobile market. These manufacturers have flooded the market with competitively priced devices that target consumers who prioritize value over the branding of premium products. As these companies gain traction, they are increasingly siphoning off market share from established players like Apple and Samsung. This dynamic presents both challenges and opportunities, particularly for major brands that must find ways to innovate and differentiate their offerings.

However, the profitability picture remains skewed. Even though Xiaomi and Huawei experience significant sales volumes, their profit margins are considerably lower due to their pricing strategies. Consequently, they find themselves relying on volume sales to remain profitable rather than high margins, which Apple continues to exploit. This ongoing situation emphasizes how the presence of low-cost competitors affects pricing strategies and profit distribution across the smartphone market, pushing companies like Apple to reinforce their brand prestige and product value.

Apple vs Android: The Ongoing Competition

The rivalry between Apple and the Android ecosystem continues to define the smartphone market. Apple’s iPhones maintain a loyal customer base that values the seamless integration of hardware, software, and services. In contrast, Android manufacturers such as Samsung, Google, and the aforementioned Xiaomi and Huawei cater to a broader audience with diverse pricing strategies and an array of device functionalities. This competition leads to constant innovation and adaptation within both camps, as each aims to capture a larger slice of the market share.

Despite the fierce competition, Apple’s unique brand identity and ecosystem contribute to its ability to secure a substantial portion of the profits in the industry. While Android devices cater to various price points and features, many consumers remain drawn to the perceived quality and prestige associated with iPhone ownership. This loyalty and brand-centric approach enable Apple to sustain its position at the top of the profit hierarchy, even amidst an aggressive market landscape filled with low-cost competitors.

The Rise of Chinese Brands and Market Share

With the rapid expansion of Chinese smartphone manufacturers like Xiaomi and Huawei, the competitive landscape has changed significantly. These companies have successfully introduced high-quality devices at lower price points, appealing to a growing consumer base in both emerging and developed markets. This shift is crucial; it challenges Apple’s and Samsung’s market shares, as consumers increasingly consider value over brand loyalty. The surge of these brands has forced traditional powerhouses to rethink their strategies to retain their competitive edge and profitability.

Despite their rising market share, the profits for these Chinese brands remain comparatively low due to their aggressive pricing models. The Canaccord Genuity analysis highlights that a significant portion of the profits in Q3 2015 was still concentrated in Apple’s hands, revealing how brand prestige can translate into higher margins. Apple’s focus on premium products and its ecosystem of services allows it to thrive financially, even as the market sees an increase in affordable alternatives.

The Role of Software and Ecosystem in Profitability

A critical factor contributing to Apple’s high-profit margins lies in its robust ecosystem, which includes seamless software integration, unique services, and a dedicated app environment. The company benefits from a loyal customer base that often invests in additional services such as iCloud, Apple Music, and various app purchases, elevating its overall profitability beyond mere hardware sales. This integration allows Apple to maintain a competitive edge over Android devices, which often rely more on volume sales and external services not fully controlled by the manufacturer.

On the other side, many Android manufacturers experience pressure to innovate not just in hardware but also in services to enhance their profitability. Brands like Microsoft and Xiaomi focus on generating post-purchase revenues through apps, accessories, and services. However, these initiatives have yet to achieve the same level of integration and consumer loyalty seen in Apple’s ecosystem. Apple’s continued investment in its software and services can significantly impact its profits, allowing it to dominate market territories that rely heavily on consumer loyalty and integrated experiences.

Consumer Behavior: The Apple Loyalty Phenomenon

Understanding consumer behavior is vital in analyzing Apple’s sustained profit dominance in the smartphone market. Consumers are often willing to pay a premium for iPhones, driven by factors such as brand loyalty, perceived quality, and status. Apple has cultivated a brand identity that resonates strongly with consumers, leading to a sense of community among iPhone users. This phenomenon plays a significant role in Apple’s ability to command a substantial profit share despite only accounting for a small percentage of global smartphone sales.

Moreover, the company’s marketing strategies amplify this loyalty, creating an aspirational connection with the brand. This unique approach not only influences initial purchase decisions but also encourages repeat purchases as customers upgrade their devices. The challenge for Android manufacturers lies in replicating this level of loyalty and brand devotion, especially when they often compete in price-sensitive segments of the market. Apple’s ability to maintain consumer trust and connection directly correlates to its impressive profit figures in a highly competitive industry.

Financial Analysis of Apple’s Market Position

A thorough financial analysis of Apple’s market position reveals strengths and vulnerabilities amidst a changing smartphone landscape. Apple’s revenue streams largely stem from its innovation-driven approach, high-quality products, and robust brand loyalty. This financial structure allows Apple to sail smoothly through competitive challenges posed by low-cost manufacturers and the Android ecosystem. Analysts suggest that Apple’s strategic focus on high-end devices places them in a favorable position to continue generating significant profits.

In contrast, many Android manufacturers grapple with thinner margins and fluctuating market shares, relying on significant volume sales to remain viable. As brands like Huawei and Xiaomi grow, leveraging lower price points and capturing market segments that prefer affordability, Apple’s financial strategies must adapt to ensure continued profitability. Understanding these dynamics is crucial for stakeholders and investors seeking to gauge Apple’s long-term financial health and market positioning.

Challenges Facing Apple Amidst Rising Competition

Despite its leading position, Apple faces challenges that could threaten its dominance in the smartphone market. The rise of low-cost competitors, particularly from Chinese brands like Xiaomi and Huawei, has resulted in intensified competition that could undermine Apple’s market share. The shift toward budget-friendly options makes it imperative for Apple to ensure that its premium-priced devices continue to offer unmatched value in both functionality and ecosystem integration.

Additionally, as consumers become more educated and discerning about their purchasing decisions, the allure of premium pricing may wane. If competitors can continue to produce high-quality devices that incorporate the latest technology and features at lower prices, Apple may need to reassess its pricing strategies and innovation cycles. Enduring loyalty to the Apple brand is crucial, and how effectively the company manages these challenges will determine its ability to maintain its profit margins and market share in the evolving smartphone landscape.

Future Outlook: Apple’s Strategy in a Competitive Landscape

Looking ahead, Apple’s strategy in the competitive smartphone market will likely focus on sustaining its premium brand image while innovating within its ecosystem. Continued investment in research and development will be essential for Apple to remain on the cutting edge of technology, ensuring that its devices can compete effectively against increasingly sophisticated low-cost offerings. Furthermore, Apple’s commitment to its services and software integrations will play an influential role in maintaining customer loyalty and driving profitability.

To navigate the challenges presented by a dynamic market, Apple may explore strategic partnerships and collaborations that enhance its product offerings and extend its reach into emerging markets. With a clear focus on maintaining quality while also addressing the growing demand for affordability, Apple’s future in the smartphone sector could be a blend of innovation, strategic pricing, and continued emphasis on delivering unparalleled customer experiences that set its products apart from Android competitors.

Frequently Asked Questions

What were Apple smartphone profits like in Q3 2015?

In Q3 2015, Apple smartphone profits were remarkable, as the company secured about 94% of total smartphone profits, despite only holding a 13.4% share of total smartphones shipped globally during that quarter.

How does Apple’s market share compare to its smartphone profits?

Apple’s market share in Q3 2015 was only 13.5% of the global smartphone market, yet it achieved an impressive 94% of the total profits for that period, highlighting the profitability of its iPhone sales compared to competitors.

What factors contributed to Apple’s dominance in smartphone profits?

Apple’s dominance in smartphone profits can be attributed to its brand loyalty and premium pricing strategy, which allows it to sell its iPhones at higher prices compared to lower-cost competitors like Xiaomi and Huawei.

How do Xiaomi and Huawei affect Apple’s smartphone profits?

While Xiaomi and Huawei have gained significant smartphone market share through their low-cost devices, they operate on thinner profit margins. Therefore, they do not compete directly with Apple regarding overall smartphone profits, which remains dominated by the iPhone.

What challenges does Apple face from the Android competition in smartphone profits?

Apple faces challenges from Android competitors, particularly with brands like Samsung, Xiaomi, and Huawei expanding their reach in the market. However, the loyalty of Apple customers and the premium pricing of its products help maintain high smartphone profits despite this competition.

Why is there skepticism regarding Canaccord Genuity’s profit analysis for Q3 2015?

Canaccord Genuity’s profit analysis for Q3 2015 has been met with skepticism due to the exclusion of many lower-cost smartphone manufacturers like Huawei and Xiaomi, which are rapidly capturing market share and profits, indicating that the overall profit landscape may be more competitive than reported.

How have low-cost smartphones influenced Apple’s profit margin?

Low-cost smartphones from brands like Xiaomi and Huawei have influenced Apple’s profit margin by increasing competition in the smartphone market. However, Apple’s strategy of focusing on high-quality, premium-priced iPhones allows it to maintain a considerable share of profits despite this pressure.

What is the significance of the rivalry between Apple and Android in terms of smartphone profits?

The rivalry between Apple and Android ecosystems plays a significant role in shaping smartphone profits, as Apple’s premium pricing and brand loyalty contrast sharply with Android manufacturers’ focus on affordability, ultimately influencing consumer choice and profitability in the market.

| Key Point | Details |

|---|---|

| Apple’s Profit Share | In Q3 2015, Apple captured 94% of total smartphone profits. |

| Market Share | Apple held a mere 13.4% share of total smartphones shipped globally. |

| Competitors | Brands like Xiaomi and Huawei have gained market share with low-cost devices but operate on thin profit margins. |

| Samsung’s Performance | Samsung managed to gain only 11% of total profits in Q3 2015. |

| Industry Analysis | Canaccord Genuity noted that the data may not reflect the full landscape due to the rise of Chinese manufacturers. |

| Consumer Loyalty | Apple’s loyal customer base is willing to wait in long lines for new product releases. |

Summary

Apple smartphone profits reached an astonishing 94% during Q3 2015, showcasing the company’s dominance in the market despite its small share of total smartphone shipments globally. This disparity highlights the effectiveness of Apple’s branding and the loyalty of its consumer base, as well as the challenges posed by lower-cost competitors in the smartphone industry.